kiberguru.ru

News

203k Renovation Loan Rates

:max_bytes(150000):strip_icc()/FHA203kloans-425c04160ace4051a9a31b731fe3e2ee.png)

Section (k) insures mortgages covering the purchase or refinancing and rehabilitation of a home that is at least a year old. A portion of the loan. For purchase transactions, total loan amount can be up to 75% of either the purchase price plus renovation costs or the “as-completed” appraised value. With funds from an FHA k loan, borrowers can choose from a or year fixed-rate loan or a number of adjustable-rate mortgage (ARM) options and can be. To apply for an FHA k renovation or refinance loan, start here. Or Today's Rates · Contact Us · Branch Locations · Find a Mortgage Loan Originator. FHA K Renovation Loan (Purchase & Refi). Want to repair and rehabilitate a damaged home? Costs can rapidly get out of control. If your score is between and , you have to put down at least 10%. At least three years must have passed since any foreclosures. Mortgage insurance. An FHA (k) Renovation Loan is a government-backed mortgage that combines the costs of a home purchase (or refinance) with the costs of home renovations. The maximum FHA loan amount for a k rehab loan is calculated by taking the purchase plus the rehab loan amount and then taking % of this total amount. FHA (k) Rehabilitation mortgages allow first-time homebuyers to take advantage of below-market interest rate loans that includes the purchase price of the. Section (k) insures mortgages covering the purchase or refinancing and rehabilitation of a home that is at least a year old. A portion of the loan. For purchase transactions, total loan amount can be up to 75% of either the purchase price plus renovation costs or the “as-completed” appraised value. With funds from an FHA k loan, borrowers can choose from a or year fixed-rate loan or a number of adjustable-rate mortgage (ARM) options and can be. To apply for an FHA k renovation or refinance loan, start here. Or Today's Rates · Contact Us · Branch Locations · Find a Mortgage Loan Originator. FHA K Renovation Loan (Purchase & Refi). Want to repair and rehabilitate a damaged home? Costs can rapidly get out of control. If your score is between and , you have to put down at least 10%. At least three years must have passed since any foreclosures. Mortgage insurance. An FHA (k) Renovation Loan is a government-backed mortgage that combines the costs of a home purchase (or refinance) with the costs of home renovations. The maximum FHA loan amount for a k rehab loan is calculated by taking the purchase plus the rehab loan amount and then taking % of this total amount. FHA (k) Rehabilitation mortgages allow first-time homebuyers to take advantage of below-market interest rate loans that includes the purchase price of the.

NJ Lenders Corp is a Direct FHA k lender ready to help you navigate this unique program. There are many homes on the market that require some TLC. Our K Loan Rates Are Low & Our Process Quick & Painless. An FHA K loan is a loan backed by the federal government and given to buyers who want to buy. Your k Renovation Mortgage Financing Specialist ; Base Loan Amount, ; % Upfront MIP, ; Total Financed Loan, ; Monthly Payment. NJ, PA, FL & CT K home loans. Get great rates on a k mortgage loan today - don't miss these deals! FHA k guidelines are similar to a Standard or “regular” FHA loan without any rehab funds. FHA k Streamline rates are also comparable to Standard FHA loans. Year Fixed Rate: % Interest Rate % APR. Year Fixed Rate: % Interest Rate % APR. 5/1 ARM: % Interest Rate %. Turn your current home into one you love! Finance your entire project with the first renovation-specific home equity loan! The k rehab loan comes with additional fees and reserve requirements. They can total 10% - 25% of the cost of your rehab project, though, they can be added. FHA Standard k Loans. ×. What is the FHA Standard (k) Renovation Loan? A renovation mortgage provides financing. Combination Loan: Unlike standard mortgages, the FHA k loan consolidates the purchase of a home and the cost of its repairs into a single mortgage. This. k loan requirements. If you're interested in buying a home that requires renovation work or would like to upgrade your current. The Standard (k) loan has a minimum requirement of $5, in renovation costs and covers structural repairs. It is designed for buyers who want to add major. An FHA k loan can be used to finance up to % of the value of your home after your improvement project, as long as your project doesn't last longer than. The FHA k loan allows a buyer to purchase or refinance a home in “as is” condition and complete major renovations or just some updating under one loan. The maximum FHA loan amount for a k rehab loan is calculated by taking the purchase plus the rehab loan amount and then taking % of this total amount. When financing either a FHA k renovation purchase or refinance transaction borrowers must keep in mind that the interest rate on the FHA k renovation loan. You can cash-out up to $35, for your home renovation projects and maintain a mortgage balance that exceeds the value of the home. And though FHA k loans. With this type of loan, you may benefit from lower interest rates and costs Additional costs may apply. Download your free Renovation Guide Today! Eligible Property Types for a FHA k Loan. To be eligible, the subject property must be a family dwelling that has been completed for at least one year. The difference with an FHA k loan is that a supplemental origination fee is charged on the repair & rehab portion. That amount is % of the repair or rehab.

How Much Interest Will I Earn On $1 000 Dollars

Our savings account calculator will help you see how much interest your savings account is earning—or if it's time to change banks to earn more. How much would you have using compound interest? 3. How long will it take your $1, to double in value if it earns 5% compounded annually? Compound Interest. Use the Dollar Bank interest calculator to help you develop a savings plan that will meet your goals. With the No Penalty CD, withdraw all your money any time after the first 6 days following the date you funded the account and keep the interest earned with no. You obtain a $1, bond that pays 5% interest annually that matures in 5 years. How much interest will you earn? Show Solution. Of course, an extra $ doesn't sound like much, but at the end of 10 years, your $1, would grow to $1, with compound interest. The 1% interest rate. You will have earned $2, in interest. How much will savings of $1, grow over time with interest? What if you add to that. Earn % APY or higher by moving your savings into a high-yield account. · When choosing a high-yield account, look for one that provides a competitive APY. The interest you'll earn on $1, depends on the interest rate of the account and how long you store it there. The longer it's saved and the higher the. Our savings account calculator will help you see how much interest your savings account is earning—or if it's time to change banks to earn more. How much would you have using compound interest? 3. How long will it take your $1, to double in value if it earns 5% compounded annually? Compound Interest. Use the Dollar Bank interest calculator to help you develop a savings plan that will meet your goals. With the No Penalty CD, withdraw all your money any time after the first 6 days following the date you funded the account and keep the interest earned with no. You obtain a $1, bond that pays 5% interest annually that matures in 5 years. How much interest will you earn? Show Solution. Of course, an extra $ doesn't sound like much, but at the end of 10 years, your $1, would grow to $1, with compound interest. The 1% interest rate. You will have earned $2, in interest. How much will savings of $1, grow over time with interest? What if you add to that. Earn % APY or higher by moving your savings into a high-yield account. · When choosing a high-yield account, look for one that provides a competitive APY. The interest you'll earn on $1, depends on the interest rate of the account and how long you store it there. The longer it's saved and the higher the.

Long-term investing can be a great way to save for your future. Use our compound interest calculator to see how your investments could grow over time. View. When calculating simple interest, it's as easy as multiplying your principal balance by the given interest rate to find how much you'll earn in a year. For. How to calculate compound interest. To calculate how much $2, will earn over two years at an interest rate of 5% per year, compounded monthly: 1. Divide. Based on monthly compounding, the same initial deposit ($1,) earning the same interest rate (4%) would lead to a balance of $1, after five years. That's. $1, at percent APY will only be $1, at the end of 10 years. But $1, at 5 percent APY will be $1, after 10 years. And if you added just $ To see just how money grows in a high-yield savings account, CNBC Select used Bankrate's compound interest calculator to determine how much money you would need. In other words, by staying invested, you can earn interest on all the other interest you've earned before. Figuring out how to invest $1, can be a great. Simple interest is calculated on the initial sum of money deposited. If you deposit $1, in an account with a 3% annual simple interest rate, you'll earn $ Using a savings calculator allows you to see how fast your money will grow when put in an interest-earning account. Understanding interest rates and how much interest you're earning can be a confusing task. Utilize our Ally savings interest calculator to make it all add. A 1% APY would give you a % monthly interest rate (1 divided by 12 is ). Now, you have your monthly interest rate and can start to calculate how much. After 10 years, you will have earned $6, in interest for a total balance of $16, But remember, this is just an example. Savings account APYs are. Earn % APY or higher by moving your savings into a high-yield account. · When choosing a high-yield account, look for one that provides a competitive APY. Compound Interest means that you earn "interest on your interest", while can invest them to get interest on them (ergo compound interest). The. The interest you'll earn on $1, depends on the interest rate of the account and how long you store it there. The longer it's saved and the higher the. I = Total simple interest; P = Principal amount or the original balance; r = Annual interest rate; t = Loan term in years. Under this formula, you can. To calculate how much the cost of a fixed "basket" of consumer purchases Interest earned, after inflation effects: Total future value of investment. How does a savings account earn interest? ; Initial Deposit, $1,, $1, ; 1 year, $1,, $1, ; 2 years, $1,, $1, ; 5 years, $1,, $1, So on a $1, deposit, you would earn $ rather than just $ as with annual compounding. On a $, deposit it would be $45 more. Determine how much your money can grow using the power of compound interest. * DENOTES A REQUIRED FIELD. Calculator. Step 1: Initial Investment. Initial.

Professional Finance Software

Make your organization more profitable using financial reporting, embedded analytics, and AI-driven insights with Dynamics Finance software. Empower is one of the best personal finance apps on the market. The service's free budgeting tool allows you to track income, spending, and saving over time. Industry-leading financial planning software dedicated to helping people talk about money. Robust solutions for advisors, planners, RIAs, and others. Download free personal finance software to monitor all your bank accounts, spending budgets and checkbook register. Keep track of your money with this easy. With Workday Financial Management, you get deep finance and accounting capabilities and real-time business Professional & Business Services. Public. Alteryx for Finance Professionals · Calculators. Spreadsheets. · Financial Planning & Analysis · Accounting Analytics · Tax Analytics · Experience Automated Insights. Best Accounting & Finance Software Products for · AP Automation · Purchasing · Expense Management · ERP Systems · Spend Management. Best. Software Solutions For Financial and Professional Services. Re-engineer your business in a way that delivers lasting savings and sustainable improvements in. SAP Business One Professional automates all your key accounting processes and automatically detects irregularities and inefficiencies in your record keeping. It. Make your organization more profitable using financial reporting, embedded analytics, and AI-driven insights with Dynamics Finance software. Empower is one of the best personal finance apps on the market. The service's free budgeting tool allows you to track income, spending, and saving over time. Industry-leading financial planning software dedicated to helping people talk about money. Robust solutions for advisors, planners, RIAs, and others. Download free personal finance software to monitor all your bank accounts, spending budgets and checkbook register. Keep track of your money with this easy. With Workday Financial Management, you get deep finance and accounting capabilities and real-time business Professional & Business Services. Public. Alteryx for Finance Professionals · Calculators. Spreadsheets. · Financial Planning & Analysis · Accounting Analytics · Tax Analytics · Experience Automated Insights. Best Accounting & Finance Software Products for · AP Automation · Purchasing · Expense Management · ERP Systems · Spend Management. Best. Software Solutions For Financial and Professional Services. Re-engineer your business in a way that delivers lasting savings and sustainable improvements in. SAP Business One Professional automates all your key accounting processes and automatically detects irregularities and inefficiencies in your record keeping. It.

Streamline and automate your tax processes Firms that need professional tax and accounting software that offers extensive electronic filing services and. PFC has recovered outstanding receivables for healthcare providers, retailers, financial organizations, and government agencies since The company's. With decades of experience serving financial services companies of all sizes, Sage empowers you to overcome the complexities of accounting and management. Money Pro is a simple tool to track and manage your finances with ease and deep understanding. It will help you cut spending, achieve financial goals, and. List of Best Accounting Software · 1. NetSuite · 2. QuickBooks · 3. Sage Intacct · 4. Xero · 5. FreshBooks · 6. Thomson Reuters CS Professional Suite · 7. For both seasoned finance professionals and those seeking to enter the field, a deep dive into the world of Finance Manager tools is not just an academic. Moneydance is a powerful yet easy to use personal finance app for Mac, Windows, Linux, iPhone and iPad. With online banking, online bill payment. Accurate budgets, plans & forecasts you can trust. Vena transforms Microsoft Excel into your ultimate financial planning and analysis software. Small Business Finance Software After instant savings. Checksoft Home & Business - License + 1 Year Maintenance - 1 user - download - Quicken Classic. Today's top-performing financial associations and organizations require integrated solutions that align with their business goals. enSYNC provides connected. Finance & Accounting - Shop for downloadable softwares like Microsoft Office, McAfee antivirus, productivity software, operating systems and many more from. Take charge of your financial future with the McGill Personal Finance Essentials course sponsored by RBC Future Launch and The Globe and Mail. Sign up now. Joy Pilot is just the accounting software you can rely on when it comes to managing your taxes and growing your business. Odyssey Professional Fee Finance Software (PFF) provides you with fast, quick and reliable tools at your fingertips to calculate and process professional fee. Trimble Viewpoint construction software solutions, part of Trimble Connected Construction, allow contractors to better manage their projects, processes and. Fully integrated with specialized CTRL software, CTRL/Finance delivers unrivalled accounting sophistication in the professional services, construction and. Accounting firm software from CS Professional Suite is the most complete line of integrated software and services for tax and accounting professionals. Drake Software is a complete professional tax preparation program for federal and state returns, business and individual. See why professional preparers. Financial software allows users to track expenses, cash, and other metrics both personally and professionally. Discover the 10 best financial software. With NetSuite's general ledger capabilities, accounting professionals gain flexibility and visibility, richer reporting functionality, enhanced audit trails and.

What Are Good Loan Rates

Loan Rates. Table data for Personal Auto Loans (Fixed Rates). Effective 08/08/ Unsecured personal loan · $3, minimum loan amount · Rates range from % to % APR Excellent credit required for lowest rate · No origination fees. The average overall interest rate for personal loans is %, same as last week. Lenders use your financial history to decide if you qualify and how much you can borrow - it helps if you have a good credit score and have kept up with debt. Personal loans can be a great way to eliminate high-interest credit card debt. But it's crucial to know the pros and cons of a loan for this purpose. 4 min. The major bank with the lowest interest rate for a personal loan is Barclays, which advertises APRs of % - %. Other notable banks with low personal. Calculate the rate and payment of your personal loan with U.S. Bank's personal loan calculator. Learn what you could qualify for today! As of Sept. 9, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. In Alabama, most lenders in our data are offering rates at or below %. · Data table · Explore what a lower interest rate means for your wallet. Loan Rates. Table data for Personal Auto Loans (Fixed Rates). Effective 08/08/ Unsecured personal loan · $3, minimum loan amount · Rates range from % to % APR Excellent credit required for lowest rate · No origination fees. The average overall interest rate for personal loans is %, same as last week. Lenders use your financial history to decide if you qualify and how much you can borrow - it helps if you have a good credit score and have kept up with debt. Personal loans can be a great way to eliminate high-interest credit card debt. But it's crucial to know the pros and cons of a loan for this purpose. 4 min. The major bank with the lowest interest rate for a personal loan is Barclays, which advertises APRs of % - %. Other notable banks with low personal. Calculate the rate and payment of your personal loan with U.S. Bank's personal loan calculator. Learn what you could qualify for today! As of Sept. 9, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. In Alabama, most lenders in our data are offering rates at or below %. · Data table · Explore what a lower interest rate means for your wallet.

Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate jumbo mortgage.

A good interest rate on a personal loan is generally one that's at or below the national average. Lenders will also consider your creditworthiness when. good idea to look for the best personal loan rates available to you. Consider different sources of personal loans, from brick-and-mortar lenders to sites online. Lenders only need to offer this rate to 51% of successful applicants – typically those with the best credit ratings. Only borrow what you actually need. Even. Car Loans - New. Put key to ignition and lock in a great loan rate. Start by getting pre-approved to. The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a relationship discount of %. Compare different loan rates and choose the best personal loan for your needs. Contact a local lender today to get started. Serving NEPA and Lehigh Valley. A mortgage interest rate is the percentage you pay to borrow money for a home loan. The best way to understand how mortgage rates work is to see them in. Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, In Alabama, most lenders in our data are offering rates at or below %. · Data table · Explore what a lower interest rate means for your wallet. What is a good interest rate on a personal loan? For Personal Loans, APR ranges from % to % and origination fee ranges from % to % of the loan amount. APRs and origination fees are determined. Bottom line. History tells us that taking out loans at 5% to 10% APR might not be a big deal if you can handle the financial obligation. However, the best. Personal loans can be a great way to eliminate high-interest credit card debt. But it's crucial to know the pros and cons of a loan for this purpose. 4 min. Assets borrowed can include cash, consumer goods, vehicles, and property. Because of this, an interest rate can be thought of as the "cost of money"—higher. Average personal loan rates* on 3-year loans were at % APR, down from % last week and up from % a year ago. · Average personal loan rates* on good idea to look for the best personal loan rates available to you. Consider different sources of personal loans, from brick-and-mortar lenders to sites online. %% Interest rate · $2, to $50, Loan amount · 36 to 60 months2 Term · No origination or application fees, and no prepayment penalty Fees. Calculate the rate and payment of your personal loan with U.S. Bank's personal loan calculator – good. – very good. + excellent. Save The average personal loan interest rate is dependent on several factors, including the amount borrowed, credit history, and income, among others. Getting approved for a low-interest personal loan depends on your credit profile, including credit history and score, income, and debt.

Us Bank Cardless Atm

What is a MoneyPass® ATM? MoneyPass is a surcharge-free ATM network. This means you don't have to pay an ATM fee for getting cash. Please note that deposits. You can find Allpoint ATMs virtually anywhere your travels may take you, throughout the United States and around the globe. With over 55, participating. Find nearby U.S. Bank ATMs in seconds with our ATM locator. Look for it in the U.S. Bank Mobile App or at kiberguru.ru Dip Card Reader - Card Stays Visible · Insert your card into the ATM with the chip facing up. · Follow the screen instruction to complete the ATM transaction. Get more information for U.S. Bank Atm in Lincoln, NE. See reviews, map, get the address, and find directions. Banks may charge non-customers $ to $ per withdrawal, while non-bank ATM operators may charge up to $10 per transaction. Try to stay within your bank's. This US Bank's ATM has contactless. Tested it and can confirmed this ATM only works for US Bank contactless debit cards for now. Bank of America; Chase; Wells Fargo; PNC. A good clue as to whether or not an ATM has cardless payment capabilities is to look for the contactless payment. How do I add a debit card to my digital wallet? Your virtual card can be used online, at the ATM or wherever contactless purchases can be made. What is a MoneyPass® ATM? MoneyPass is a surcharge-free ATM network. This means you don't have to pay an ATM fee for getting cash. Please note that deposits. You can find Allpoint ATMs virtually anywhere your travels may take you, throughout the United States and around the globe. With over 55, participating. Find nearby U.S. Bank ATMs in seconds with our ATM locator. Look for it in the U.S. Bank Mobile App or at kiberguru.ru Dip Card Reader - Card Stays Visible · Insert your card into the ATM with the chip facing up. · Follow the screen instruction to complete the ATM transaction. Get more information for U.S. Bank Atm in Lincoln, NE. See reviews, map, get the address, and find directions. Banks may charge non-customers $ to $ per withdrawal, while non-bank ATM operators may charge up to $10 per transaction. Try to stay within your bank's. This US Bank's ATM has contactless. Tested it and can confirmed this ATM only works for US Bank contactless debit cards for now. Bank of America; Chase; Wells Fargo; PNC. A good clue as to whether or not an ATM has cardless payment capabilities is to look for the contactless payment. How do I add a debit card to my digital wallet? Your virtual card can be used online, at the ATM or wherever contactless purchases can be made.

U.S. cash-ready. Cross-border cash has never been easier with one of the largest USD bank machine networks in Canada. BMO Branch Locator. Find BMO bank hours, phone number or visit a local branch or ATM for our wide range of personal banking services. Once you've confirmed the ATM allows for cardless ATM access, you can follow the prompts to withdraw cash. Instead of inserting your debit card, you'll tap your. ATMs offer a convenient way to access funds, whether you're at home or traveling — in the US or overseas. And to find one nearby, you can use our ATM locator. U.S. Bank participates in MoneyPass®, an ATM surcharge free network. To find MoneyPass ATM locations, select “visit the MoneyPass locator” at the bottom of our. M posts. Discover videos related to Bdo Debit Card Maximum Withdraw Us Bank How to make cardless withdrawal? #atm#bank#debitcard#atmcard#banking. Your Northwest Bank debit card may be used to make withdrawals from any ATM in the United States. Better yet, if there is a transaction fee, we reimburse that. ATM Surcharge: Non-U.S. Bank ATM owners may apply a surcharge fee on ATM transactions at their ATMs. U.S. Bank participates in MoneyPass®, an ATM surcharge free. Cardless ATMs allow you to get money and conduct other transactions without swiping or inserting your debit card into a card reader. Other fees may apply from your bank and ATM operator. More convenient. MYTH We're always here when you need us. Get Support · Report a. Make fast, secure mobile payments with U.S. Bank in your digital wallet, supporting Apple Pay, Google Pay, Samsung Pay, PayPal, Fitbit Pay & Garmin Pay. Savings interest rate Lift applies to Standard Savings only. When changing checking account types, corresponding Non-U.S. Bank ATM transaction fee waivers will. Can I withdraw U.S. dollars at a TD ATM in. From Allpoint, the largest surcharge-free ATM network, to ReadyCodeTM, the cardless US banks combined. Allpoint ATMs, exclusively placed in retail locations. You can also get cash back with purchases at participating merchants or withdraw cash at ATMs, banks or credit unions. The amounts of purchases, bill payments. A contactless card allows you to quickly tap your credit or debit card for payment. You simply place your card against the Contactless Symbol. ATM locations; ATM locator. KNOWLEDGE BASE. How can I request a new U.S. Bank Nicollet Mall Minneapolis, MN © U.S. Bank. end of main. The bank's customers will be able to use their smartphones to access any of the bank's 13, ATMs. Other major U.S. banks have rolled out card-free ATMs in. For many banks, daily ATM withdrawal limits start at $ You have the power to set your own ATM withdrawal limit through the U.S. Bank mobile app. As long as. You can take care of your routine banking needs 24/7, quickly and safely. We made it easy for you to change your HSBC ATM & Debit Card PIN at any U.S. HSBC ATM.

Dog Insurance Plans Cost

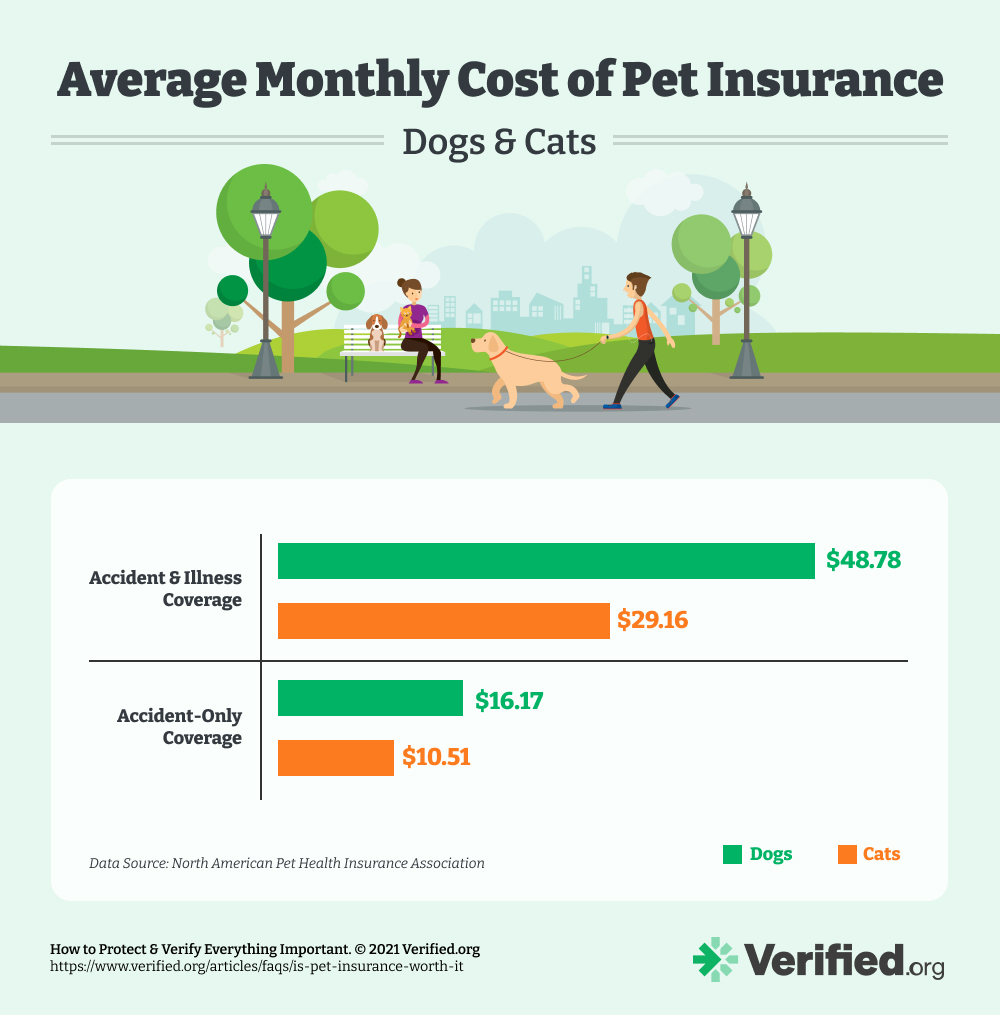

For these reasons, the average insurance cost for dogs ranges widely – from about $25 to almost $ a month, adds U.S. News. Ultimately, though, costs are. First year cost for a large dog: average of $ CarePlus has plans that cover Accidents, Illnesses and Wellness costs which you can bundle together to. Our most popular coverage starts at around $90/month for two dogs, which includes a 5% multi-pet discount. Two cats on our most popular plan would cost about. How much does pet insurance cost? To provide you the best pet insurance to fit your budget and needs, we offer personalized policies for your pet(s). That. Eligible expenses are repaid by check or direct deposit into your PET INSURANCE POLICIES ARE UNDERWRITTEN BY INDEPENDENCE AMERICAN INSURANCE COMPANY. On average, comprehensive coverage costs $ for dogs and $ for cats each year. These policies may exclude pets with pre-existing or genetic conditions. So. On average, dog insurance costs just over $88 per month, but premiums differ for every dog owner. To find the cheapest dog insurance, compare plan costs from. Pet insurance to help protect your fur babies. Save up to 25% on coverage for dogs and cats. See note 1 Get a quote online or call Embrace at The average monthly pet insurance premium is $ for dogs and $ for cats, according to the latest report published by the North American Pet Health. For these reasons, the average insurance cost for dogs ranges widely – from about $25 to almost $ a month, adds U.S. News. Ultimately, though, costs are. First year cost for a large dog: average of $ CarePlus has plans that cover Accidents, Illnesses and Wellness costs which you can bundle together to. Our most popular coverage starts at around $90/month for two dogs, which includes a 5% multi-pet discount. Two cats on our most popular plan would cost about. How much does pet insurance cost? To provide you the best pet insurance to fit your budget and needs, we offer personalized policies for your pet(s). That. Eligible expenses are repaid by check or direct deposit into your PET INSURANCE POLICIES ARE UNDERWRITTEN BY INDEPENDENCE AMERICAN INSURANCE COMPANY. On average, comprehensive coverage costs $ for dogs and $ for cats each year. These policies may exclude pets with pre-existing or genetic conditions. So. On average, dog insurance costs just over $88 per month, but premiums differ for every dog owner. To find the cheapest dog insurance, compare plan costs from. Pet insurance to help protect your fur babies. Save up to 25% on coverage for dogs and cats. See note 1 Get a quote online or call Embrace at The average monthly pet insurance premium is $ for dogs and $ for cats, according to the latest report published by the North American Pet Health.

Costly veterinary care shouldn't get in the way of your pet thriving, but it often isn't in the budget. With customizable coverages and rates, Progressive Pet. Customers Rate Us #1 · #1 Customer-rated pet health insurance plan 7 years in a row* · More than , pet parents · No enrollment or administrative fees. dog health insurance plans can help provide a financial safety net. insurance plans can help you choose medical care without worrying about costly vet bills. Pet Insurance from State Farm® & Trupanion® helps protect dogs, cats, and owners from the high costs of veterinary care. Get a free quote today. The average cost of dog insurance hovers around $88 per month, according to quotes analyzed by Investopedia. But much like our canine companions, rates vary. How much does dog insurance cost? Several factors determine the cost of dog insurance. These include your dog's breed and age and the policy's deductible and. Protect the things you love most, including your pets. Farmers Pet Insurance plans The price of a BestBenefit Accident and Illness plan is based on your pet's. Get paid back quickly for covered vet expenses via direct deposit or check – your choice! See the difference a Pumpkin Dog Insurance plan can make! Dog insurance coverage. Protect yourself from costly vet bills with the right dog health insurance plan. What our. Pet owners trust Nationwide to protect more than 1,, pets · Pet insurance premiums starting at $25/mo. · Visit any licensed veterinarian in the United. Premiums for pet health insurance are based primarily on your dog or cat's age, breed, location, and your plan's annual limit, deductible, and reimbursement. At Lemonade, a policy for a dog or a cat starts at $10/month. (Plus our affordable pet health insurance has won the approval of authorities like kiberguru.ru). Covered conditions: Some pet health insurance policies may reimburse covered medical expenses for accidents, illnesses, surgeries, X-rays, prescriptions. Find the best pet insurance plan for your pet. Shop pet insurance plans that cover wellness, illness, accidents & more. Use any vet. Get a free quote today! But when your pal needs unexpected veterinary care, the costs often add up fast. A good dog health insurance plan helps cover these costs so you can say. The average cost for the most common pet insurance plans (accident-illness plans)is $29/mo for cats and $47/mo for dogs. This coverage reimburses emergency care. You pay just $15 per month for any pet, regardless of age, size, gender, or breed. Plus, your cost won't go up just because you make a claim. Affordable pet. If a pet gets sick or hurt, vet bills can add up. We work with Trupanion to offer medical insurance for pets. Get a medical insurance plan for your pet. Pet insurance for dogs can help cover vet fees, medications, diagnostic tests and more. Learn about Fetch dog insurance with plans averaging $35/month. Based on our research and data compiled from sales of pet insurance policies over the last year, the average cost of pet insurance is $50 per month for a dog.

V Cash

kiberguru.ru, Ibadan, Nigeria. likes · 3 talking about this · 57 were here. VCASH Money Transfer made easy in Nigeria Western Union pick up Phone. CASH V - Cash Equivalents They produce record mix and master all their. IDR spellbalmond bentukbentuklaporankeuangankoperasi totalbilirubin slotgacorbetmurah. vcash was a Malaysian digital wallet and online payment platform established in Shah Alam in November , by Digi Telecommunications, a subsidiary of. VUSXX vs Cash Plus - NY State. Investing Questions. Im trying to understand the investment loss or cost if I choose to throw money into VUSXX. Gross revenue shows how much the firm is selling. Cash flow indicates the business's liquidity and shows how much cash is coming in and out. The live Vcash price today is $0 USD with a hour trading volume of $0 USD. We update our VC to USD price in real-time. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. fight card. Saturday 22 June fight card. Saturday 22 June Tyler Denny. VS VS. Denny wins by TD: , , VS Felix Cash. Find the best free apps like Vcash for Android. More than 26 alternatives to choose: 99 Cattle:Make Money Anytime, Cash Base: Flash Loan, Cash Pokket. kiberguru.ru, Ibadan, Nigeria. likes · 3 talking about this · 57 were here. VCASH Money Transfer made easy in Nigeria Western Union pick up Phone. CASH V - Cash Equivalents They produce record mix and master all their. IDR spellbalmond bentukbentuklaporankeuangankoperasi totalbilirubin slotgacorbetmurah. vcash was a Malaysian digital wallet and online payment platform established in Shah Alam in November , by Digi Telecommunications, a subsidiary of. VUSXX vs Cash Plus - NY State. Investing Questions. Im trying to understand the investment loss or cost if I choose to throw money into VUSXX. Gross revenue shows how much the firm is selling. Cash flow indicates the business's liquidity and shows how much cash is coming in and out. The live Vcash price today is $0 USD with a hour trading volume of $0 USD. We update our VC to USD price in real-time. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. fight card. Saturday 22 June fight card. Saturday 22 June Tyler Denny. VS VS. Denny wins by TD: , , VS Felix Cash. Find the best free apps like Vcash for Android. More than 26 alternatives to choose: 99 Cattle:Make Money Anytime, Cash Base: Flash Loan, Cash Pokket.

The class action lawsuit concerns a cyberattack on Cash Express' network that occurred between January 29, , and February 6, VUSXX vs Cash Plus - NY State. Investing Questions. Im trying to understand the investment loss or cost if I choose to throw money into VUSXX. kiberguru.ru, Ibadan, Nigeria. likes · 3 talking about this · 57 were here. VCASH Money Transfer made easy in Nigeria Western Union pick up Phone. Grand Theft Auto 5 GTA V Collectors Edition Cash Money Bank Deposit Bag Key. VCash is a digital currency or cryptocurrency designed to be used as electronic cash. It is updated with the revolutionary Mimblewimble privacy. 3 Vehicles in GTA V. Explore the World of Collision Point. Presented by NHTSA. Methamphetamine Lab. GTA Wiki. The Open Road. GTA Wiki. Cocaine Lockup. GTA Wiki. v. Cash Express LLC, Case No. CV, in the 13th Judicial District, Circuit Court of Putnam County, Tennessee. Final Hearing. 11/09/ Settlement. Current and historical cash on hand for Visa. As a result, it is important to know whether a reference to a tax liability or tax rate relates to the cash tax paid or the book tax expense. The most. Indication: Cash flow shows how much money moves in and out of your business, while profit illustrates how much money is left over after you've paid all your. Understand the cash flow statement for Visa Inc. (V), learn where the money comes from and how the company spends it. The live Vcash price today is $0 USD with a hour trading volume of $0 USD. We update our XVC to USD price in real-time. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Holding cash and investing in bonds are both viable options for those looking to protect their savings from a volatile market. Followers, Following, Posts - V Cash (@vcashforever) on Instagram: "Educator & Artist Music:@vitocashmusic @smoppfi @surprisesax Education. Cash is king in this town. Solve your money problem and help get what you Grand Theft Auto V · Red Dead Redemption 2 · Red Dead Redemption · Grand Theft. Actual Cash Value (ACV) The amount of money needed to fix your home, minus the decrease in value of your property because of age or use. A surety bond for jail serves as a guarantee for the court that the defendant will fulfill their obligations. Unlike a cash bond where you pay the court. TPG points valuation. See what a point or mile is worth with our appraisals of a loyalty program's currency, based on redemption values. Award vs. cash. The price of Vcash (XVC) is $ today with a hour trading volume of $ This represents a % price decline in the last 24 hours and a %.

Personal Loan Requirements

In addition to basic personal info, you'll need your Social Security Number or Individual Tax Identification Number, employment history and income, and expenses. Some lenders, particularly traditional banks, may require you to apply in person. Either way, the loan application will ask for personal and financial. In general, the following minimum loan amounts are required for extended term loans: $25, for loan terms of 61 to 84 months; $30, for loan terms of 85 to. Personal loans that don't require collateral are called unsecured loans. But without collateral, the interest rate on the loan may be higher. Interest is a. Personal loans at Santander Bank are unsecured and do not require collateral. This means that you do not need to provide any personal assets, like your vehicle. Ask your Preferred Banker for details and eligibility requirements. Interest will accrue during the day no payment period. Investment Secured loan and. To be eligible for a personal loan, you are required to have an open Wells Fargo account for at least 12 months. Use a personal loan for just about anything. A. Your address and proof of residence; The desired loan amount and terms. Other documentation may be needed depending on your specific financial situation, but. A personal loan doesn't require your home or car as collateral, so you won't have to deal with inspections or appraisals. mobile phone and hand with cash. In addition to basic personal info, you'll need your Social Security Number or Individual Tax Identification Number, employment history and income, and expenses. Some lenders, particularly traditional banks, may require you to apply in person. Either way, the loan application will ask for personal and financial. In general, the following minimum loan amounts are required for extended term loans: $25, for loan terms of 61 to 84 months; $30, for loan terms of 85 to. Personal loans that don't require collateral are called unsecured loans. But without collateral, the interest rate on the loan may be higher. Interest is a. Personal loans at Santander Bank are unsecured and do not require collateral. This means that you do not need to provide any personal assets, like your vehicle. Ask your Preferred Banker for details and eligibility requirements. Interest will accrue during the day no payment period. Investment Secured loan and. To be eligible for a personal loan, you are required to have an open Wells Fargo account for at least 12 months. Use a personal loan for just about anything. A. Your address and proof of residence; The desired loan amount and terms. Other documentation may be needed depending on your specific financial situation, but. A personal loan doesn't require your home or car as collateral, so you won't have to deal with inspections or appraisals. mobile phone and hand with cash.

The Takeaway. Qualifications for a personal loan typically include a credit score of or more, proof of income, and a debt-to-income ratio below 30%. Some. Credible takeaways · Lenders assess your credit score, income, debt-to-income ratio, and other factors when deciding whether to approve you for a loan. · You. PSECU personal loans can provide flexible cash. Explore PSECU personal loan rates, and use the PSECU loan calculator to estimate your PSECU loan payment. The minimum loan amount is $ The minimum term for Personal loans below $1, is 6 months. The minimum term for Personal loans equal to or greater than. What are the requirements for a personal loan? · Have a valid U.S. SSN. · Be at least 18 years old. · Have a minimum individual or household annual income of at. To be eligible for our unsecured loans or lines of credit, you must have a Regions deposit relationship (checking, savings, MM or CD) on which you are an owner. To qualify, a borrower must be a U.S. citizen or other eligible status, be residing in the U.S., and meet SoFi's underwriting requirements. Not all borrowers. Before you close your loan, OneMain will need the following documents from you: A copy of a valid, government-issued ID (driver's license or passport); Your. To qualify for a personal loan you should have some credit established and an income source. While there may be other requirements you need to meet, these are. Personal Loan Application Checklist · Social Security Number · Purpose of the loan · Current employer's name and address · Previous employer's name and address (if. Great for home repairs, remodeling or efficiency upgrades · No collateral required · $25, minimum loan amount for 61 to 84 months and $30, minimum loan. What are the requirements for a personal loan? · Have a valid U.S. SSN. · Be at least 18 years old. · Have a minimum individual or household annual income of at. Getting Approved · Finance terminology can be complicated. Here are some simple explanations of the factors considered in your loan application. · Credit Score ->. Requirements · Be a U.S. citizen or current resident (we accept applications from all U.S. states and Washington, D.C.; however,we don't accept applications from. To qualify, a borrower must be a U.S. citizen or other eligible status and meet lender underwriting requirements. The borrower is required to meet applicable. The minimum loan amount is $ The minimum term for Personal loans below $1, is 6 months. The minimum term for Personal loans equal to or greater than. A personal loan is a term loan with a fixed interest rate that is disbursed in a lump sum, while a personal line of credit allows you to borrow as many times as. Application Process for an Unsecured Personal Loan · Be 18 years of age or older · Live within the following states: AK, CO, CT, ID, IN, MA, ME, MI, NY, OH, OR. Borrowers may need at least a fair credit score to qualify for an unsecured personal loan. But keep in mind that the minimum credit score required for a. Personal Loan Features · Loan consolidation, home expenses or emergencies · No collateral required for these unsecured personal loans · Loans from $1, to $

Best Way To Boost Credit Score With Credit Card

How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep. Try not to skip payments if possible, and avoid getting close to your credit limit on your cards. It's a good idea to keep your balance on revolving lines under. 1. Make On-Time Payments · 2. Pay Down Revolving Account Balances · 3. Don't Close Your Oldest Account · 4. Diversify the Types of Credit You Have · 5. Limit New. Many credit-scoring models consider the number and type of credit accounts you have. A mix of installment loans and credit cards may improve your score. However. The Top 5 Things For Raising Your Credit Quickly · 1. Lower Your Credit Utilization Ratio · 2. Make Multiple Payments · 3. Avoid Hard Credit Pulls · 4. Ask For a. Still, focusing on good financial practices like paying off your credit card balances in full each month will go a long way towards increasing your credit score. 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4. Ask to have negative entries that are paid. Get a copy of your credit report and remove errors · Pay down credit card balances to under 30 percent · Activate old cards · Become an authorized user. 5 ways to improve your credit score · Pay your bills on time · Keep your balances low · Don't close old accounts · Have a mix of loans · Think before taking on new. How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep. Try not to skip payments if possible, and avoid getting close to your credit limit on your cards. It's a good idea to keep your balance on revolving lines under. 1. Make On-Time Payments · 2. Pay Down Revolving Account Balances · 3. Don't Close Your Oldest Account · 4. Diversify the Types of Credit You Have · 5. Limit New. Many credit-scoring models consider the number and type of credit accounts you have. A mix of installment loans and credit cards may improve your score. However. The Top 5 Things For Raising Your Credit Quickly · 1. Lower Your Credit Utilization Ratio · 2. Make Multiple Payments · 3. Avoid Hard Credit Pulls · 4. Ask For a. Still, focusing on good financial practices like paying off your credit card balances in full each month will go a long way towards increasing your credit score. 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4. Ask to have negative entries that are paid. Get a copy of your credit report and remove errors · Pay down credit card balances to under 30 percent · Activate old cards · Become an authorized user. 5 ways to improve your credit score · Pay your bills on time · Keep your balances low · Don't close old accounts · Have a mix of loans · Think before taking on new.

Need to boost your credit score? These 4 programs can help (for free) · 1. Experian Boost · 2. TurboTenant Rent Reporting · 3. UltraFICO · 4. Grow Credit. How to improve your credit scores · 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on past-. Review your credit report · Create a plan · Consider a debt consolidation loan or balance transfers to a lower rate credit card · Research working with a credit. A quick and easy way to improve your credit score is to register on the electoral roll. · Although this won't directly · If you rent, make sure your rent payments. How to Build Good Credit · Review your credit reports. · Get a handle on bill payments. · Use 30% or less of your available credit. · Limit requests for new credit. According to FICO, the lower your credit utilization ratio, the better. Keeping it below 10% – while continuing to make on-time payments – can help you. Pay off debt rather than moving it around: the most effective way to improve your credit scores in this area is by paying down your revolving (credit card) debt. One of the easiest ways to improve your credit score is by paying your bills on time every month. This will start to eliminate your credit card debt. Your. Three ways to raise a credit score quickly are to pay off outstanding debts, ask for an increased credit limit and become an authorized user on someone else's. How to Build or Improve Credit with a Credit Card · Apply For a Credit Card That Matches Your Spending Goals · Understand How Much of Your Available Credit You're. The fastest way to get a credit score boost is to lower the amount of revolving debt (which is generally credit cards) you're carrying. The percentage of credit. Ideally, you want a credit utilization ratio of below 10%. First, if you carry a credit card balance from month to month, pay that off asap. The interest rates. Try to keep balances below 25% of your available credit limit. How a credit card could damage your credit score. To. Trying to raise your credit score? · Keep track of your progress. · Always pay bills on time. · Keep credit balances low. · Pay your credit cards more than once a. FICO says paying down your overall debt is one of the most effective ways to boost your score. Don't close paid-off accounts. Closing unused credit card. Don't Close Unused Credit Card Accounts. The age of your credit history matters, and a longer history is better. If you must close credit accounts, close newer. 1. Pay your bills when they're due. · 2. Keep credit card balances low. · 3. Check for errors. · 4. Make a plan to pay down debt. · 5. Keep using your credit . Paying your bills on time is the cardinal rule of maintaining a good credit score. That's because your payment history—meaning whether you've paid your past. 1. Pay down credit card debt · 2. Pay credit card bills by the closing date · 3. Ask for a credit limit raise · 4. Piggyback on someone else's good credit · 5.

Gemini Credit Card Annual Fee

Pros · No annual fees · No transaction fees · Debit card — no need for a credit assessment · Earn crypto back. No annual fees, but there are minimum monthly repayments. · Available as a virtual card on Google and Apple Pay. · % to % APR. · % unlimited BTC. No annual fees: The Gemini Credit Card has no annual fee and no foreign transaction fees1. There are no exchange fees to receive crypto rewards2. This APR will vary with the market based on the Prime Rate. The variable penalty APR is % and may be applied if you make a late payment or. Pros · Up to 3% cashback on purchases made with the card with no annual fee · This is a real credit card, not a crypto debit card · Manage or freeze your card from. Related Cards ; Annual Fee: $0* ; Grace Period: 25 days* ; Min Finance Charge: $ ; Min Credit Line: $ ; Late Payment Fee: See Terms*. No Annual Fee Unlike some other crypto reward credit cards, the Gemini Credit Card has no annual fee. This means you can earn crypto rewards without worrying. Packed with innovative tools and advanced functionalities, this software offers a range of benefits. Instant Crypto Rewards; No Annual Fee; Multiple Crypto. The Gemini Credit Card has a $0 annual fee and provides access to Mastercard benefits. The Gemini Credit Card might not make sense if you're new to digital. Pros · No annual fees · No transaction fees · Debit card — no need for a credit assessment · Earn crypto back. No annual fees, but there are minimum monthly repayments. · Available as a virtual card on Google and Apple Pay. · % to % APR. · % unlimited BTC. No annual fees: The Gemini Credit Card has no annual fee and no foreign transaction fees1. There are no exchange fees to receive crypto rewards2. This APR will vary with the market based on the Prime Rate. The variable penalty APR is % and may be applied if you make a late payment or. Pros · Up to 3% cashback on purchases made with the card with no annual fee · This is a real credit card, not a crypto debit card · Manage or freeze your card from. Related Cards ; Annual Fee: $0* ; Grace Period: 25 days* ; Min Finance Charge: $ ; Min Credit Line: $ ; Late Payment Fee: See Terms*. No Annual Fee Unlike some other crypto reward credit cards, the Gemini Credit Card has no annual fee. This means you can earn crypto rewards without worrying. Packed with innovative tools and advanced functionalities, this software offers a range of benefits. Instant Crypto Rewards; No Annual Fee; Multiple Crypto. The Gemini Credit Card has a $0 annual fee and provides access to Mastercard benefits. The Gemini Credit Card might not make sense if you're new to digital.

Earn weekly rewards on your crypto collateral with our credit card. Created by HODLers for HODLers. No annual fees, no late payment fees, no foreign transaction. If your Annual/Fixed-Term Plan is billed monthly, you're charged each month for one month's portion of your annual charge. In your monthly credit card or bank. Pros · No annual fees · No transaction fees · Debit card — no need for a credit assessment · Earn crypto back. Annual Fee. $0 ; APR. % to % Variable ; Upgraded Points · Expertise You Can Trust ; Don't Get If. You have no interest in investing in or earning crypto. No annual fees and percent is not a huge deal with credit cards as pretty much all of them give you similar rewards at no fee. Packed with innovative tools and advanced functionalities, this software offers a range of benefits. Instant Crypto Rewards; No Annual Fee; Multiple Crypto. Skip to main content I love the Gemini Credit Card: r/Gemini Best Credit Card With No Annual Fee · Best Airline Credit Card · Best. Annual Fee. $0 ; APR. % to % Variable ; Upgraded Points · Expertise You Can Trust ; Don't Get If. You have no interest in investing in or earning crypto. No Annual Fee Unlike some other crypto reward credit cards, the Gemini Credit Card has no annual fee. This means you can earn crypto rewards without worrying. $0 annual fee · Earn 4% cash back per dollar spent on gas and EV charging purchases up to $ in spend per month on the first year, 1% thereafter, 3% cash back. No annual fees, but there are minimum monthly repayments. · Available as a virtual card on Google and Apple Pay. · % to % APR. · % unlimited BTC. This APR will vary with the market based on the Prime Rate. The variable penalty APR is % and may be applied if you make a late payment or. Gemini Credit Card Annual Fee. There is no annual fee on Gemini credit cards. The interest rate on Gemini Credit Cards. The platform charges a variable APR from. Your Binance Visa Card comes completely free! Binance does not charge any processing or administrative fees. Binance Funding Wallet allows you to hold crypto. The SoFi credit card is a great option for anyone looking to earn rewards on their everyday purchases. With no annual fee and up to $ in cash back, it's a. Pros · Up to 3% cashback on purchases made with the card with no annual fee · This is a real credit card, not a crypto debit card · Manage or freeze your card from. No annual fees: The Gemini Credit Card has no annual fee and no foreign transaction fees1. There are no exchange fees to receive crypto rewards2. The Gemini Credit Card has a $0 annual fee and provides access to Mastercard benefits. The Gemini Credit Card might not make sense if you're new to digital. No Annual Fee Not having to worry about any annual fees is also a significant advantage of the Gemini credit card. Cons of Gemini Credit Card Mastercard. No. Applies if your card is lost or stolen. Rates and fees. Annual Fee. $ Rewards Rate. 1%-4%. Intro APR. N/A. Ongoing Variable APR. % - %. APR.

1 2 3 4 5